Supply Chain Trade Credit Order Purchasing

Streamlined Supply Chain

Solutions with Send 123

Supplier Management and Quality Control

We can take charge of supplier management, conducting rigorous quality control inspections ensuring the highest level of product quality.

Seamless Logistics Organization

Our team can expertly organize your logistics, ensuring products are moved swiftly and efficiently.

Convenient, Easy to Manage 90 Day Repayment Terms

Enjoy favorable repayment terms of up to 90 days, enabling you to manage your finances more efficiently and effectively.

Supplier Payments

Once your purchase orders are approved, we make direct payments to your suppliers on their terms, allowing you to concentrate on your core business.

The Old Way

Purchase Order Financing (Factoring)

Purchase Order (PO) Factoring in its purest form is a type of commercial lending that allows a business to receive financing for a pre-ordered project using the purchase order from their client as collateral. The inherent problems with this model are Three-fold.

The factoring company buys the receivable from you, and they require contact and a new agreement with your customer directly and they must perform credit due diligence on that customer.

The factoring company requires your customer to communicate with them to pay them directly then they forward you what's left. Effectively cutting you out of the client relationship and customer service.

The factoring company often pays less than 100% of the PO value requiring you to put up cash in advance & Factoring companies do not assist in the paperwork, shipping, and logistics; quality control nor customer service.

These problems within this model are very invasive upon your business. It breaks the golden rule of supplier/customer confidentiality and puts your clients’ in an uncomfortable situation. It further erodes the trust between you and your client.

The New Way

Purchase Trade Credit Made Simple:

With the Send 123 trade credit supply program, we make the onboarding easy and we don't cause any friction with your customers.

Experience a seamless supply chain process with Send 123

NO personal credit checks

NO hard credit checks on your business

NO lien registrations

NO interaction, contract or payments from your customer

We assist in the paper work, quality control, and shipping (where applicable)

NO equity dilution

Minimal Documentation

We pay your supplier 100% of the Purchase Order Value

You pay us in 90 days or less

How it works

Let Send 123 be your new supplier and provide you with trade credit payment terms

SEND your irrevocable purchase order to us on your company letterhead

SEND us your supplier invoice with us as the payee

We will SEND payment to your supplier and you pay us later

Easy approval underwriting process

We establish a credit limit for each client up front and you can place as many orders as you like until you have maxed out your limit. The approval is as easy as 123:

In order to get your business approved, simply complete our 5-minute application form.

We submit this information to our underwriting team, and they do a basic review, KYC and due diligence on your business.

Approvals can be as fast as 1-3 business days, but typically we average 10-14 days on the first order. Subsequent orders are funded within 1 business day up to the maximum approved credit limit.

Note: While a D-U-N-S (Dun and Bradstreet) number is not mandatory, it would speed up the verification process.

* Subject to Send 123 approval, and standard terms and conditions. This is not a loan or line of credit. We act as your supplier, we pay for the product inventory and we offer you payment terms.

* No credit check required.

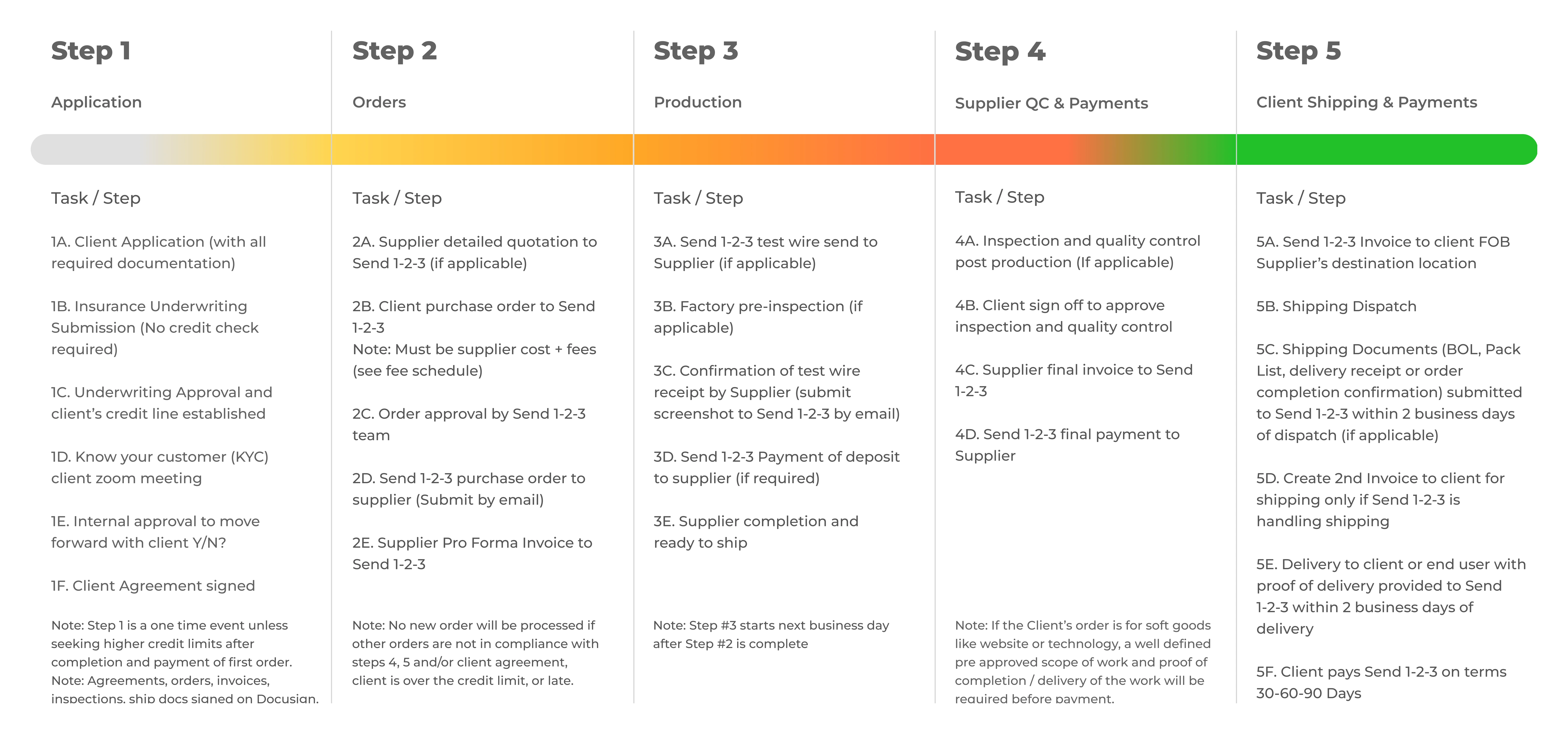

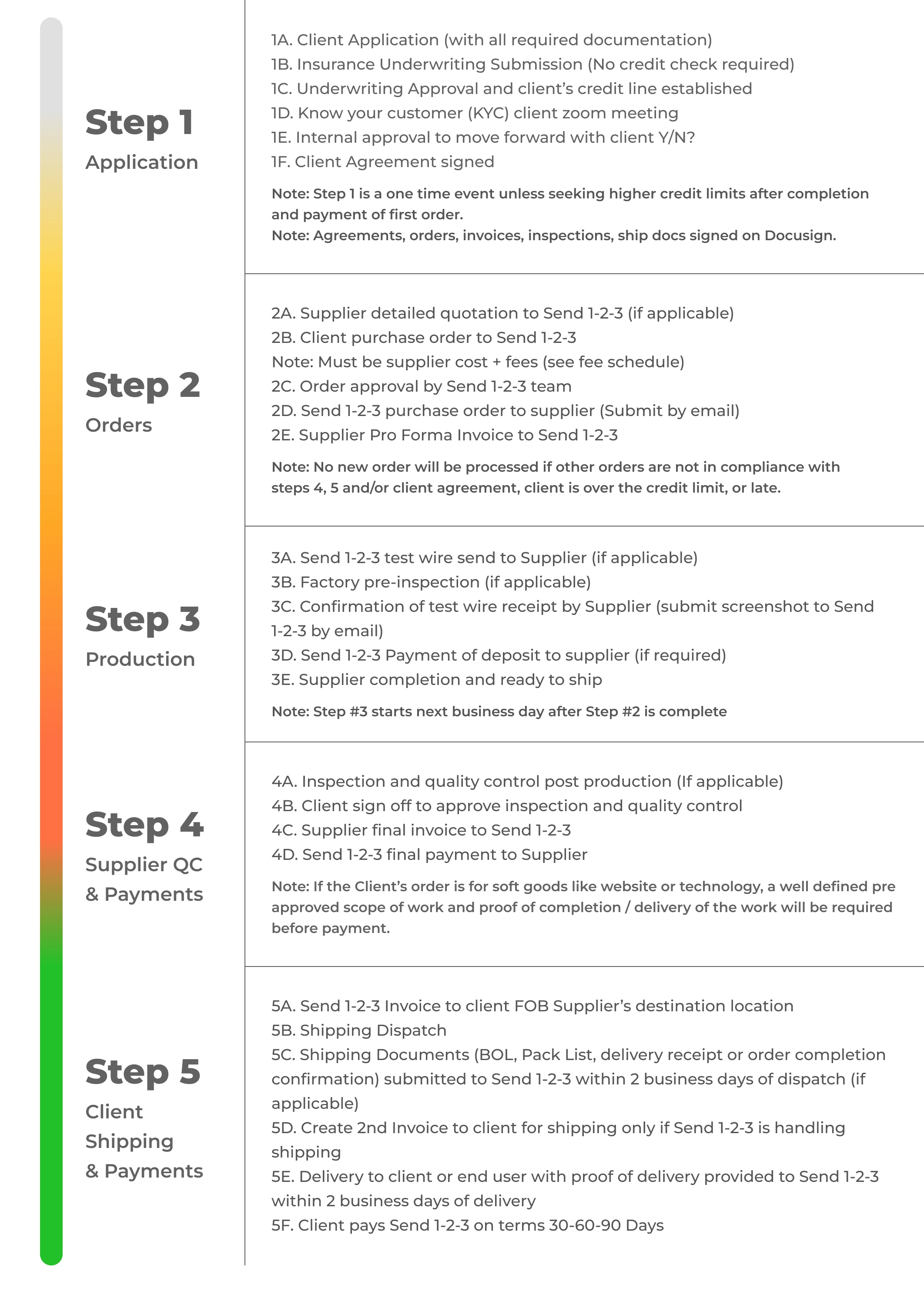

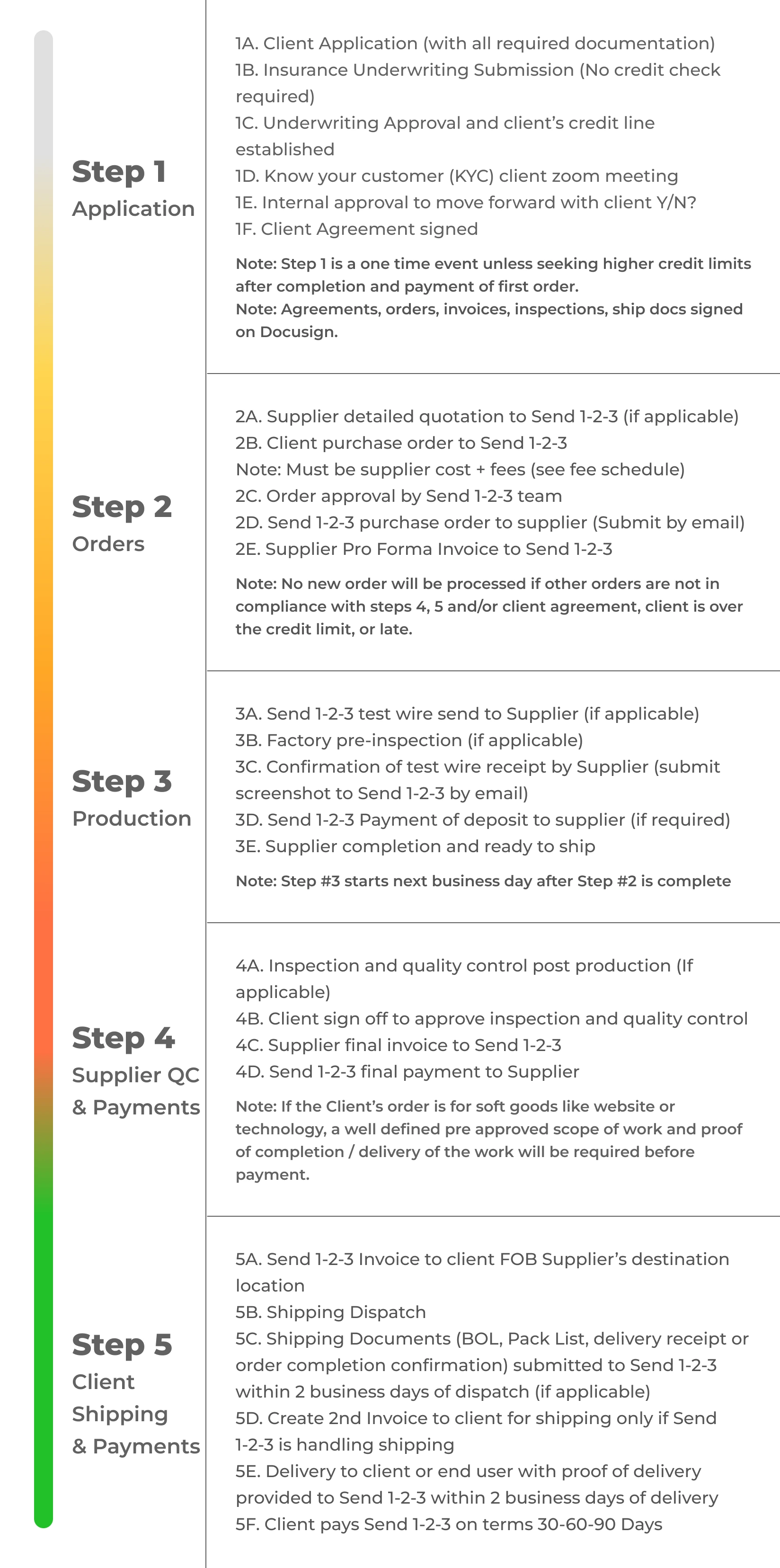

Send 1-2-3 Trade Credit Process | Step by Step

These are the standard steps which may vary on an order by order or client by client basis.

Our Fees

For providing these services, we charge a nominal mark-up on the original supplier purchase order cost. The mark-up is added to the cost of the original purchase order and the re-payment from you doesn’t occur for up to 90 days after delivery. There is no up-front out of pocket expenses or fees on your part. Here’s how we earn our management fee:

Administrative support for supplier orders

Supplier liaison and oversight

3rd party supplier payments

Quality control and 3rd party inspection (where and when applicable)

Organize freight and delivery, either to you or direct to your customer (Optional - extra fees may apply)

Transforming Businesses:

With Send 123, Unlock the Full Potential of Your Business Today!

Get Sourcing

To save money and time with our single vendor partner source for curated, high-quality business essentials and supplies.

Get Trade Credit

To secure your Trade Credit to pay your suppliers and unlock new opportunities for your business.

Get Technology

To take your eCommerce website, customer service and warehouse fulfillment to the next level..